Pf Form 15g Pdf

If you intend to make an early withdrawal from your PF of INR. 50,000 or more, you can apply for Form 15G. What is the difference between Form 15G and 15H? The main difference between Form 15G and 15H is that 15H is meant for senior citizens only. Details of Form No. 15G other than this form filed during the previous year, if any7 Total No. 15G filed Aggregate amount of income for which Form No.15G filed 19. Details of income for which the declaration is filed Sl. Identification number of relevant investment/account, etc.8 Nature of income Section under which tax.

The 15G form fill who are below the age of 60. Here I show How to Fill Form 15G For PF Withdrawal. If your provident found amount was more than 50000 and you are working more than 6 years, as well as you are not under in the income tax, then give that form you will get your full PF withdrawal amount. If you are not under in the income tax and if you don’t give that form then 10% of your PF amount will deduct during PF Withdrawal.

How To Fill Form 15G For PF Withdrawal Step By Step Process Below.

- Put the candidate the name

2. Write the PAN card number

3. In status the box writes ‘individual’

4. Here financial years, after 31 March new financial year will start. For example (2020-2021.)

5. On the residential status write the only ‘resident.’

Number 6 to 12 are your address information. 6, Flat/door/block no. 7, house name. 8, Road/Street/lane name. 9, Area/locality. 10, town/city/district. 11, state name.12, put your area pin code number and 13, give a valid Email ID.

14. Give a running phone number, if have any problem then they will contact through this number.

15. Are you income tax return person. If yes, then right sign on the box and give the year below. If not, then tick on the just no box.

16. Write the full amount, that has in your provident found account.

Pf Form 15g For Pf Withdrawal Download Pdf

17. Here put your PF amount, as well as last one-year income. Like if your PF amount 1 lakh and last one-year income 1.2 Lakh, then write here all total amount like two Lakh twenty rupees.

18. Here have two boxes, if you applied 15g form previous years then put the quantity of 15g form that you file and how much amount write in the right-side box. If not, then on the left side right put ‘0’ and right side adds ‘none.’

Noveltech character vst free download. 19. Here need four things. In the identification number… box, below give your UAN No (Universal account number.) Nature of income – PF withdrawal. Section under… – Section 192A. Amount of income – that amount has your PF account, for example (1 Lakh) /auto-tune-plug-in-for-mixcraft.html.

10th-12th Class certificate And marksheet Download Online Here

In the; ‘signature of declarant’ give your real signature that has your document any like PAN card or bank account. eset antivirus mac free download

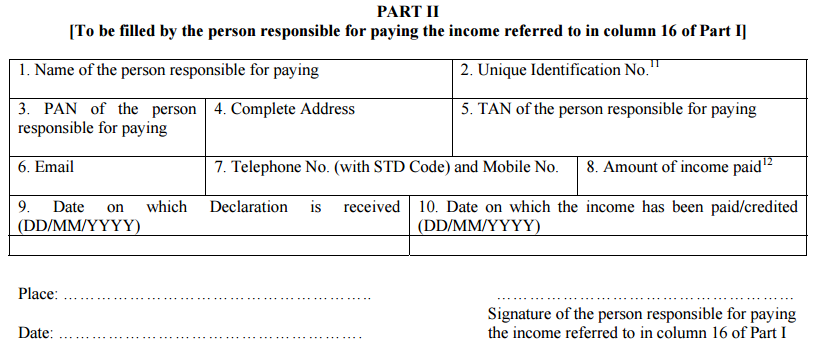

Declaration/Verification

I/We then put your name and below there have previous years ending put last financial years dates like 31/03/2020 and assessment year ‘2020-2021’ and below also same financial years that you give above.

At the last, left side put your place name as well as the current date and on the right side again give your signature.